Insurance for convicted drivers

A convicted driver insurance policy is a special insurance policy that mitigates the risks that insurance providers believe they pose on the roads. This guide will explain everything about driving convictions and the special types of insurance drivers with convictions will need to keep them on the road.

What is a driving conviction?

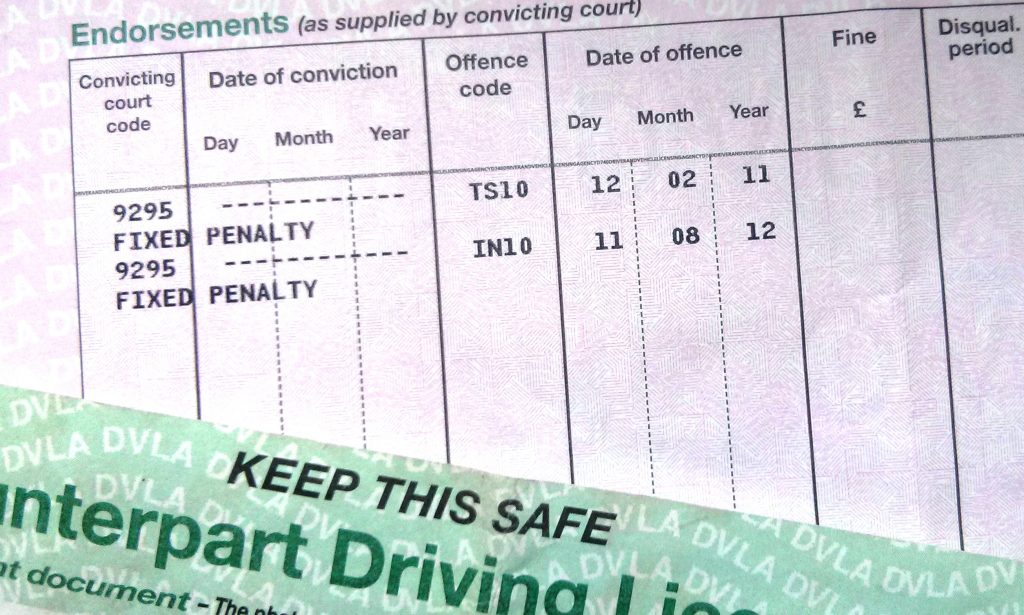

When a driver commits a driving offence and they are caught by the police, they will usually be fined and have an endorsement on their licence. Depending on how severe the driving offence is, the drivers can also be summoned in court for harsher punishments. Driving offences can range from speeding offences, driving under the influences of alcohol or drugs, traffic light offences and many more. A full list of driving convictions and endorsements can be found on the gov.uk website.

What happens when you get a driving conviction?

If the police stop a driver because they believe they have contravened the driving laws, firstly they will do checks on the vehicle and the driver to make sure they are legal to drive and the vehicle is insured, if neither is true then the police have the power to seize the vehicle and take it to the police compound. If they believe the driver is under the influence of drink or drugs they will do roadside tests to ascertain if this is true. If they conclude that it is true, they will seize the car and take the car to the compound and may escort the driver back to the police station to provide further samples such as blood and urine. If the driver has been stopped for speeding then the police will take the drivers details and they will be sent a letter through the post with the details explaining the penalties they face.

Details of what to do if a car gets impounded can be found here.

How long do convictions stay on your licence?

Most driving convictions remain on your licence for a period of 3 years from the date of the offence and can be removed after 4 years however insurance companies still want to be informed of any convictions within the last 5 years. Some severe convictions have to remain on your licence for a period of 10 years from the date of conviction, these offences are for driving under the influence of drink or drugs (DR10, DR20, DR30, DR31, DR61, DR80) and careless driving under the influence of drink or drugs or failing to provide a specimen (CD40, CD50, CD60 or CD70).

How many driving convictions are you allowed to receive?

When you receive a driving conviction your licence will be endorsed with points, each conviction has a different number of points that can be endorsed on your licence, and in cases where drivers are summoned to court and found guilty, the judge can decide to endorse any number of points he sees fit as a punishment. You are allowed a maximum number of 12 endorsement points on your licence within a 3 year period, if you go over this limit your licence will be revoked and will receive a tt99 endorsement(disqualification under totting up). A tt99 conviction stays on a licence for a period of 4 years from the date of conviction.

How does having a driving conviction affect insurance premiums?

When a driver has convictions, they are most often than not regarded as being a higher risk to insurance companies. The degree of risk varies depending on the driving conviction, for example having a single speeding conviction such as an SP30 normally does not make that much a difference to most insurers as it is common for drivers to have one because of the increase in speed traps across the country in the past couple of decades. However, having a driving conviction such as a DR10 (for drink driving) will be seen as a much greater risk and will have a much higher insurance premium. Drivers with multiple driving convictions and endorsements on their licence are seen as the highest risks for insurance companies. Because of the greater risk that drivers with convictions can be, some insurers will outright refuse to insure them, and the number of insurance companies offering convicted drivers insurance can be limited.

How can drivers get cheaper convicted driver insurance?

In order to get a cheaper insurance premium, it is best to find an insurance company that can specialise in insurance for convicted drivers. Such insurance companies can tailor policies to the risks that each driver poses no matter what conviction or combination of convictions the driver has. In order to get the best deal, ultimately it is always best practice to use an insurance comparison site that can submit your details to multiple convicted driver insurance specialists.